Welcome to the labyrinth of consumer preference, a complex puzzle that every business tries to solve. Imagine if you had a map that led you straight to what your customers truly desire. Sounds like a dream, right? But here’s the catch – the map isn’t drawn in your customers’ words; it’s charted in their actions. Let’s unpack this conundrum together.

Understanding Consumer Preference and Behavior

Have you ever said you love healthy food but then inexplicably found yourself driving through for a burger? We’ve all been there. This is the classic case of stated versus revealed preferences. People often profess one thing but do another, and this is especially true in consumer behavior. For businesses, simply asking customers what they want might not yield the most reliable data.

Why does this happen? The psychology behind our choices is influenced by numerous factors – social desirability, momentary impulses, and even the environment we’re in when making a choice. To truly understand consumer preference, we must observe behavior in context.

The Pitfalls of Predictive Questions

Now, let’s address a common pitfall: predictive questions. Asking consumers what they would do or buy in the future is like asking someone to predict the weather without a forecast – it’s a shot in the dark. Consumers’ predictions are often off because they don’t account for future contexts or mood changes.

Can you get people to tell you what they prefer- yellow or black?

Yes, with a preference survey question. Is it that simple? No. Which is why we love Katelyn Bourgoin’s Walkman post. Here are some thoughts on this idea.

How people’s attitudes and behavior are connected is a bit of a mystery. And yet, it’s natural to think a person’s attitudes and behaviors are related when directly asking people for their opinions. After all, you need an answer!

It’s more complex than directly asking people for their opinions. However, there are ways to gauge an audience’s preferences without directly asking them to pick yellow or black. You can get closer to the participant’s purchase intent.

Instead of asking, “Would you buy a yellow Walkman?” a better approach is to create a scenario: “If you were going to the beach and needed a durable music player, which Walkman color would you choose?”

Methodologies to Discover True Consumer Preferences

How do we get to the heart of consumer preference, then? Let’s talk tools and methods:

- Preference Surveys: These can be insightful but must be well-crafted to avoid bias and capture genuine preferences.

- Multivariate Testing: Present two options and see which triumphs in real-world scenarios.

- Observational Studies: Watch and learn. Sometimes consumers aren’t aware of their preferences until they act on them.

Case Study: The Yellow vs. Black Walkman

So, picture this: back in the 90s, Sony’s chatting up a bunch of teenagers about this snazzy new yellow Walkman they’ve just rolled out. The teens? Oh, they’re all over it, saying it’s the coolest thing since sliced bread.

Fast forward to the end of the focus group, and Sony hands out a little thank-you gift – a free Walkman, sweet, right?

But here’s the twist – the teens had to pick between the yellow they’d just raved about and a classic black. And would you believe it? Most of them grabbed the black one. Yep, the very same yellow they claimed to adore got the cold shoulder.

What’s the takeaway from this little trip down memory lane?

Simple. Don’t just take someone’s word on what they think they might like. Watch what they actually pick up off the shelf. Chat with the folks who’ve already bought your stuff, and really get into the nitty-gritty of their choice. Turns out, when you start digging into the real reasons behind a purchase, that’s where the gold is. You’ll end up learning a whole lot more.

The longer you work in marketing, the easier it is to accept that there are no “quick tricks” or “marketing secrets.” You need to learn from customers and then test different audiences, messages, channels, and ideas. Double-down on what works and ditch what doesn’t.

—Katelyn Bourgoin, Co-Founder, Un-Ignorable

Consumer Preference Example: Multivariate Testing of iPhone Users in the United States

We tested the consumer preference of iPhone colors with over 300 mobile phone users in the US to understand the impact of color on this product’s appeal and positioning. Here are five methods that illustrate how you can use Helio to test consumer preferences:

- Comparative Analysis

- Benefit Highlighting

- Likelihood to Recommend

- Pricing Questions

- Final Preference Question

Comparative Analysis

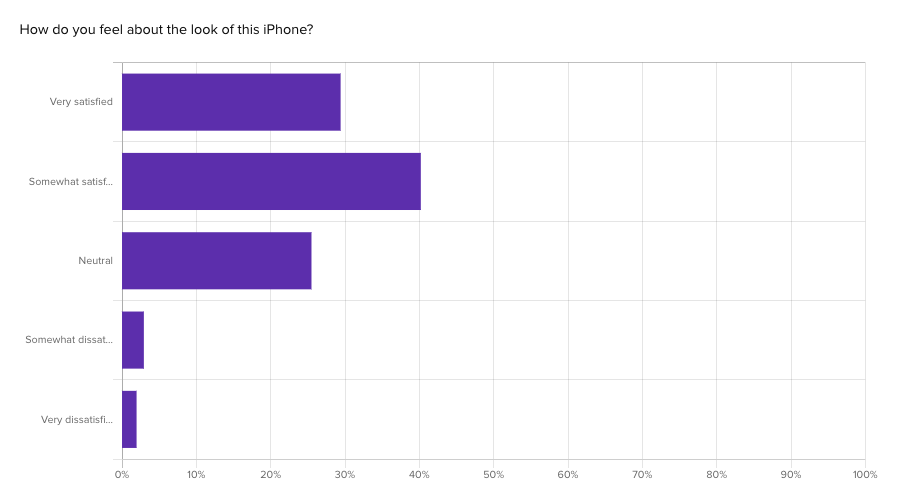

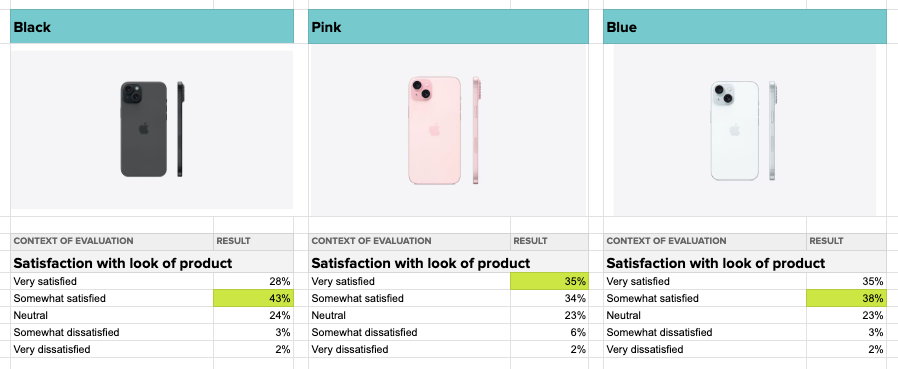

To provide a comparative baseline, we asked one group to rate a new black iPhone 15, one group to rate a pink iPhone, and another to rate a light blue iPhone.

This subjective rating was then compared across the 3 phone models to understand which color users were most attracted to:

The pink iPhone had the highest concentration of users indicating a high level of satisfaction with the look of the product, similar to how the bright yellow Walkman caught the audience’s attention in the ‘90s.

However, the light blue iPhone had the highest level of “very” or “somewhat” satisfied responses, with 73% indicating some level of satisfaction, compared to the black (71%) and pink (69%) models.

Benefit Highlighting

With this method, we asked our audience of mobile phone users in the United States to highlight the benefits of each device. Then, we gauged their reactions based on the color they were shown.

Using participants’ qualitative feedback, we looked to see whether the color of the phone made an impact on the perceived benefits of the device. Most of the comments regarding the benefit of a new iPhone centered around the possibility of new features, especially the quality of the new camera system:

Better camera, updated operative system, new features.

– Helio Participant, Mobile Phone User (US)

When isolating the responses around the pink iPhone, we found that some users were much more likely to mention the color, and appreciated the opportunity to have their phone reflect their personality:

Better sound and picture quality, new features, new color choices. It’s color is also satisfying, pink is girly!

– Helio Participant, iPhone User (US)

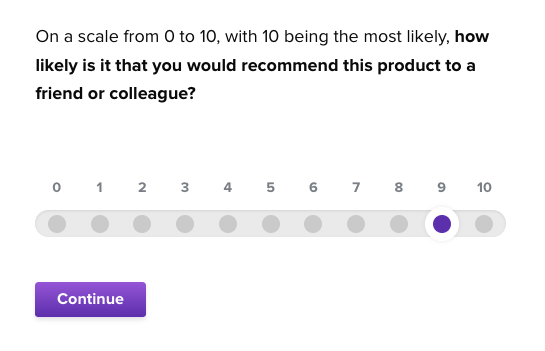

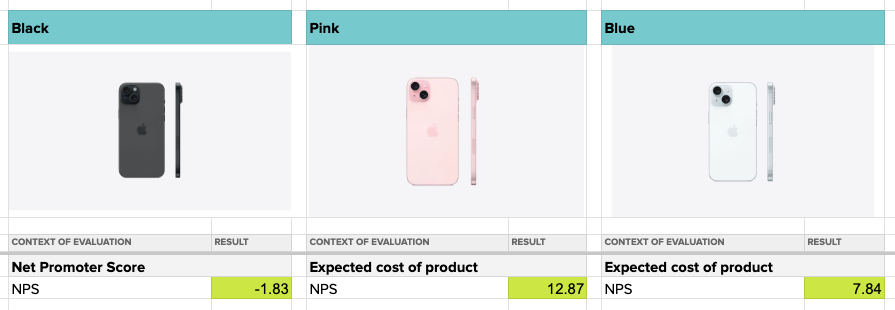

Likelihood to Recommend (Net Promoter Score)

Next, we asked participants in each audience, “On a scale from 0 to 10, with 10 being most likely, how likely is it that you would recommend this product to a friend or colleague?” This questioning looks beyond the participant’s feelings and preferences and ties their decisions to a behavior.

This Net Promoter Score (NPS) question is a tried-and-tested method of gathering impressions from product users. This asks participants to rate their likelihood of recommending the product to others based on their experiences.

This type of questions produces an NPS between -100 and +100, with a positive value representing a positive impression of the product.

When placing each product’s score side-by-side, we see that once again the brightly colored device takes the cake. The black iPhone even produced a negative NPS, indicating a possible level of disinterest in the product.

Pricing Questions

To illustrate more methods of understanding consumer preference, we asked pricing questions to determine the perceived value each audience places on the device. You can use the Westendorp Pricing Model. This will give you a sense of their perceived value of the color.

Now that we’ve evaluated the emotional reaction to the product, we next wanted to understand if what participants’ say is what they actually do. Pricing is a difficult subject, so it helps to have users come up with an expected price on their own, and then look at the mean, median, and mode of those responses.

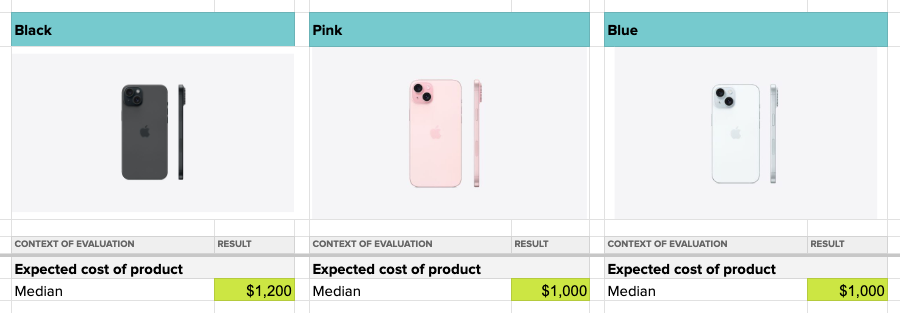

Now the true story begins to unravel, as we see the color of the phone does have an impact on expected cost, but maybe not in the way you’d expect. The pink and blue iPhones remained steady at around $1,000, however the black iPhone had a median expected price of $1,200—20% more than the other two models.

Final Preference Question

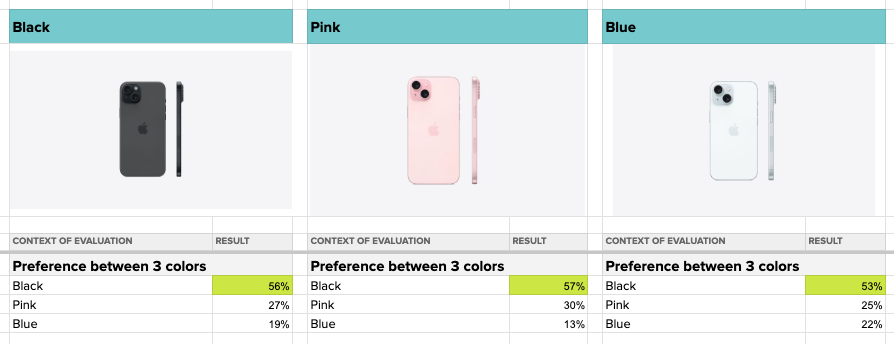

After answering questions about a single iPhone color for a few minutes, the other 2 colors were revealed to participants, and we asked a direct preference question, “Which of these devices do you prefer?” Typically, we expect to see a skew towards the dominant color presented in the survey, based on confirmation bias.

However, when we put the products right next to each other for a direct preference decision for users, the results might be considered shocking:

The clear winner across each preference question was the black iPhone, despite participants’ earlier favor towards the pink version.

Just like the Walkmans in the ‘90s, the allure of brightly colored products and expressions of personality are outweighed by the simplicity of a neutral experience:

I love the black, I don’t like getting colored phones because of phone cases. Some phone cases would not match a colored phone. I like to stick with the neutrals.

– Helio Participant, iPhone User (US)

Factors Influencing Consumer Preferences

Now, regarding what steers the ship of consumer preferences, it’s like a big, bustling market of choices. There’s a lot in the mix, from personal vibes to the size of your wallet. Let’s dive in!

Impact of Personal Taste and Cultural Factors- Your buddy can’t get enough of those fiery hot chips, but just the thought makes you chug a gallon of water? That’s personal taste for you, and it’s a huge player in the game. But it’s not just about what you like; it’s also where you’re coming from. Your roots, traditions, the local buzz – it all shapes what you’re into. It’s like your personal brand, influenced by the cultural runway you’re walking on.

Role of Income and Budget Constraints- Alright, let’s talk cash – because, let’s face it, it matters. Your bank balance isn’t just a number; it’s like your shopping assistant, whispering in your ear about what’s in reach and what’s a no-go. If you’re rolling in dough, you might spring for that top-shelf, gold-plated thingamajig. But if you’re counting pennies, you’re looking for the bang for your buck. Your income and budget are like the guardrails on your shopping highway, keeping your wallet in check.

UX and Convenience Preferences- Let’s face it, we’re all a bit lazy at heart, right? If something makes our life easier, we’re all in. That’s where user experience and convenience come in. If a product is easy to use, intuitive, and basically does the job with a cherry on top, we’re sold. It’s like that app on your phone that’s so slick you can’t help but keep swiping. Convenience is king in the land of consumer choice.

Communication and Effort Preferences- Now, how a brand talks to us can be a deal-maker or breaker. We want the straight talk, no jargon, no beating around the bush. If we can interact with a brand without breaking a sweat, why wouldn’t we? Good communication can make us fans for life, whether it’s a chatbot that understands what you’re saying or a helpline that doesn’t have you playing a guessing game with a robot.

Sensory Preferences and Their Impact- And let’s not forget the senses – sight, sound, touch, taste, smell. They’re like the VIP guests at the party. If something looks good, smells heavenly, and feels like a dream, we’re more likely to reach for it. It’s all about that sensory high-five. Brands that get this can really turn our heads. Think about the last time you bought something just because it smelled amazing – that’s sensory preference in action.

Actions over words when determining consumer preference

So there you have it. It’s a whole smorgasbord of factors and types regarding consumer preferences. Dive into this ocean, and you’ll find out it’s not just about what you sell but how you serve it up. Keep it real, keep it relatable, and always, always remember – the customer’s king. If you want to chat with someone who can help you make sense of consumer preference testing, simply reach out to an expert to start a conversation.

Navigating the maze of consumer preferences is crucial for businesses aiming to understand and fulfill customer desires. This understanding goes beyond what customers say they want, focusing instead on what they do, as real choices often differ from stated preferences due to various psychological factors.

Predictive questions about future choices can be unreliable; instead, observing actual behavior provides better insights. To accurately gauge preferences, methods like well-designed surveys, multivariate testing, and observational studies are recommended to get a better understanding. Multivariate testing further refines this understanding by comparing preferences across different groups, and analyzing benefits, pricing, and likelihood to recommend, which can uncover the real reasons behind consumer choices!

Consumer Preference FAQs

Observe their behavior in real-world scenarios, as actions often reveal more than words. Customers are not always able to predict their future actions or preferences accurately.

It’s a method to compare different variables to see which one performs better in understanding consumer behavior. You could ask different groups to rate two versions of a product and then measure their sentiment and pricing perception.

It shows the difference between stated preference in a focus group and actual choice when receiving a free product.

What did Sony learn from their focus group in the 90s? That consumers’ stated preferences don’t always match their actual purchasing behavior. It’s crucial to look beyond what consumers say and focus on what they do and why. Consider conducting your own multivariate tests and the context of consumer choices.

No, this method is often unreliable due to the unpredictable nature of future contexts and decisions. However, using observational studies, contextual inquiries, and usage diaries to gather more accurate data.