Return on Investment: Proven Strategies for Success

Maximizing Your Return on Investment: Strategies for Success. Investing your hard-earned money is always a balancing act. You want to grow your wealth, but you also want to minimize risks. That’s where Return on Investment (ROI) comes into play. Understanding ROI and implementing strategies to maximize it can make a significant difference in your financial success. In this article, we will explore the basics of ROI, the key factors that influence it, common mistakes to avoid, and techniques to measure and improve your ROI.

🔩 The Nuts and Bolts:

- Understanding ROI is Essential for Financial Success: ROI measures investment profitability by assessing the return relative to the investment cost. This metric helps in evaluating the effectiveness of investment opportunities.

- Long-Term Investments Benefit from Compounding: Longer investment durations can generate higher returns through the compounding effect, significantly enhancing ROI over time.

- Balancing Risk and Return is Crucial: Higher risk investments often offer higher potential returns. Diversifying investments helps balance risk and reward, ensuring a healthy ROI.

- Investment Costs Impact ROI: Fees, commissions, and taxes can significantly eat into your overall returns. Lowering these costs is vital to maximizing your ROI.

- Regular Performance Reviews Optimize Returns: Continuously monitoring and adjusting your investments based on performance ensures underperforming assets are addressed, maximizing your ROI.

- Reinvesting Returns Accelerates Growth: Compounding your returns by reinvesting them helps accelerate the growth of your investments, leading to higher ROI.

- Avoid Common ROI Calculation Mistakes: Overlooking indirect costs and the time value of money can skew ROI calculations, leading to inaccurate assessments of investment performance.

Understanding Return on Investment (ROI)

Before we dive deeper into maximizing ROI, let’s start by understanding the basics. ROI measures the profitability of an investment by assessing the return relative to the investment cost. It helps you evaluate the effectiveness of different investment opportunities and make informed decisions.

Return on Investment (ROI) is a key financial metric used by individuals and businesses to evaluate the efficiency and profitability of an investment. By calculating ROI, investors can determine the success of their investments and compare different opportunities to make well-informed financial decisions.

The Basics of ROI

Calculating ROI is relatively straightforward. Simply subtract the initial investment cost from the final investment value, divide it by the investment cost, and multiply by 100 to get the percentage. For example, if you invest $1,000 and your investment value grows to $1,500, your ROI would be 50%.

It is important to note that ROI does not take into account the time value of money or the risks associated with an investment. While ROI provides a useful snapshot of profitability, investors should also consider other factors such as inflation, market volatility, and opportunity costs when making investment decisions.

Importance of ROI in Business Decision Making

ROI is a crucial tool for businesses when it comes to decision making. It allows companies to analyze the profitability of potential projects, allocate resources effectively, and prioritize investments that yield the highest returns. By incorporating UX metrics such as customer satisfaction or task success rate into ROI analysis, businesses can not only maximize their profit margins but also enhance user experience, leading to long-term sustainability.

Furthermore, ROI analysis, when combined with UX metrics, helps businesses identify underperforming investments and user pain points, enabling the reallocation of resources to more profitable and user-friendly ventures. By continuously monitoring and evaluating ROI alongside UX performance, companies can adapt to changing market conditions and make strategic decisions that drive both growth and customer satisfaction.

Make your design decisions count.

Subscribe to Design Under Pressure. Get insights, UX metrics, and tools for bold, informed design.

We respect your inbox. Just insights. No fluff. Privacy Policy.

Key Factors Influencing ROI

Several factors can significantly impact your ROI. Understanding these factors will help you make informed investment decisions and maximize your returns.

When considering the time frame of your investment, it’s essential to delve deeper into the concept of compounding returns. Longer-term investments not only have the potential to generate higher returns, but they also benefit from the compounding effect, where your earnings are reinvested to generate even more earnings over time. This compounding can lead to exponential growth in your ROI, making long-term investments a powerful wealth-building strategy.

Time Frame

The duration of your investment can greatly affect the ROI. Generally, longer-term investments have the potential to generate higher returns, but they also come with increased risks. Consider your financial goals, risk tolerance, and investment timeline when evaluating the potential ROI.

Moreover, the time frame of your investment can also be influenced by external factors such as economic cycles, market trends, and global events. Keeping abreast of these factors and adjusting your investment strategy accordingly can help you navigate market fluctuations and optimize your ROI in the long run.

Risk and Return

It’s no secret that investments are inherently associated with risks. However, risks are not always a bad thing. Higher risk investments often offer higher potential returns. Evaluate your risk appetite and diversify your investments to balance risk and reward, ensuring a healthy ROI.

Furthermore, understanding the relationship between risk and return involves assessing the volatility of different asset classes. While stocks may offer higher returns, they also come with higher volatility and risk. On the other hand, bonds provide more stability but lower returns. By diversifying your portfolio with a mix of assets, you can mitigate risk while optimizing your overall ROI.

Investment Costs

Investment costs, including fees, commissions, and taxes, can eat into your overall ROI. Compare the costs associated with different investment options and consider the impact they will have on your final returns. Lower costs can significantly contribute to maximizing your ROI.

In addition to direct investment costs, it’s crucial to consider the opportunity cost of your investments. By analyzing the potential returns of alternative investment opportunities, you can ensure that you are allocating your capital to the most profitable ventures. This holistic approach to assessing investment costs can enhance your ROI by optimizing resource allocation and minimizing unnecessary expenses.

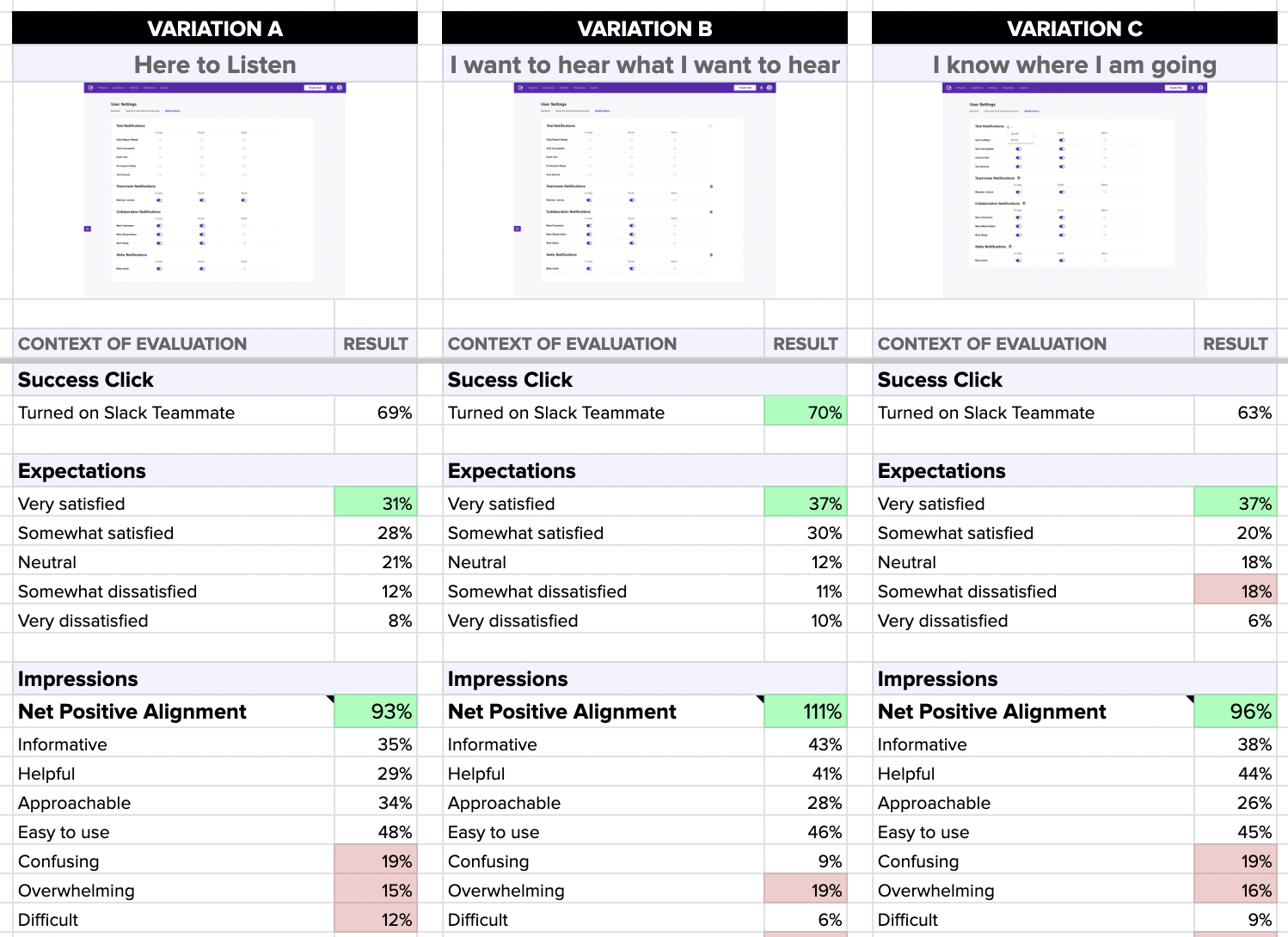

UX Metrics

Strategies to Maximize ROI

To maximize your ROI, you need effective strategies tailored to your specific investment goals. Here are some proven strategies to help you achieve success.

Investing can be a complex and challenging endeavor, but with the right approach, you can increase your chances of success and maximize your returns. By diversifying your investments, regularly reviewing performance, and reinvesting returns, you can create a solid foundation for long-term financial growth.

Diversification of Investments

Don’t put all your eggs in one basket. Diversify your investments across different asset classes, industries, and geographical regions. This lowers your exposure to any single investment and increases your chances of earning a higher overall return.

Diversification is a key risk management strategy that can help protect your portfolio from market volatility and unexpected events. By spreading your investments across various assets, you can reduce the impact of any one investment underperforming.

Regular Performance Review

Stay on top of your investments by regularly reviewing their performance. Monitor market trends, analyze your portfolio, and make adjustments as necessary. Keeping a close eye on your investments ensures you can identify underperforming assets and take necessary actions to maximize your ROI.

Performance reviews are essential for assessing the health of your investments and ensuring they align with your financial goals. By conducting regular reviews, you can identify areas for improvement and make informed decisions to optimize your portfolio.

Reinvesting Returns

When you receive returns on your investments, resist the urge to splurge. Instead, consider reinvesting them. Compounding your returns by reinvesting them helps accelerate the growth of your investment and increases the potential for higher ROI in the future.

Reinvesting returns is a powerful wealth-building strategy that can magnify the effects of compounding over time. By reinvesting your earnings, you can harness the full potential of your investments and generate exponential growth in your portfolio.

Common Mistakes in ROI Calculation

While ROI is a valuable tool, there are common mistakes that can skew your calculations and lead to inaccurate assessments of your investments.

One common mistake that many make when calculating ROI is failing to account for the intangible benefits of an investment. These benefits can include improved brand reputation, customer loyalty, or employee morale. While these benefits may not have a direct monetary value, they can have a significant impact on the overall success of an investment.

Overlooking Indirect Costs

It’s crucial to consider all the costs associated with an investment, including indirect costs. These can include maintenance fees, taxes, and any secondary expenses. Failure to account for these costs can significantly impact your ROI analysis.

Another important factor to consider when calculating ROI is the potential risks associated with an investment. Risks such as market volatility, regulatory changes, or technological advancements can all affect the returns on an investment. By overlooking these risks, you may underestimate the true ROI of a project.

Ignoring the Time Value of Money

The time value of money acknowledges that money today is worth more than the same amount in the future due to its earning potential. Ignoring this principle can lead to inaccurate ROI calculations. Always consider the time value of money when assessing the returns on your investments.

Furthermore, it’s essential to take into account the opportunity cost of capital when calculating ROI. The opportunity cost represents the potential return that could have been earned if the funds were invested elsewhere. By ignoring the opportunity cost of capital, you may not be getting a complete picture of the true returns on your investments.

🚀 If you’re using Helio

Evaluate the effectiveness of different opportunities and make informed decisions before building.

Tracking and improving your ROI is critical to long-term investment success.

Measuring and Improving ROI

Tracking and improving your ROI is critical to long-term investment success. There are several techniques you can use to effectively measure and enhance your ROI.

When it comes to measuring ROI, it’s not just about the numbers; it’s also about understanding the story they tell. Dive deeper into your ROI analysis by considering qualitative factors alongside quantitative data, such as user engagement metrics. Customer feedback, user retention rates, market trends, and competitor analysis (UX Metrics) can provide valuable insights into the performance of your investments, helping you align financial outcomes with user satisfaction and experience.

ROI Measurement Techniques

Utilize financial tools and software to accurately measure your ROI. These tools can automate calculations, provide real-time data, and generate comprehensive reports. Knowing your current ROI allows you to benchmark against industry standards and set realistic goals.

Furthermore, consider conducting scenario analysis to assess the impact of different variables on your ROI. By simulating various scenarios, you can better understand the risks and opportunities associated with your investments, enabling you to make more informed decisions.

Steps to Improve ROI

Continuous improvement is key to maximizing your ROI. Consider implementing strategies such as optimizing costs, exploring new investment opportunities, and staying updated with market trends. Additionally, seek expert advice and educate yourself on investment strategies to make informed decisions and continuously improve your ROI.

Moreover, don’t overlook the power of diversification in enhancing your ROI. By spreading your investments across different asset classes and industries, you can reduce risk and potentially increase returns. Diversification is a fundamental strategy that can help you weather market fluctuations and improve the overall performance of your investment portfolio.

Maximizing your return on investment requires a combination of knowledge, strategic thinking, and ongoing evaluation. By understanding ROI fundamentals, identifying key factors, avoiding common pitfalls, and implementing effective strategies, you can significantly increase your chances of achieving financial success. Remember, investing is a journey, and optimizing your ROI is an ongoing process that requires patience, discipline, and adaptability.

Return on Investment FAQs

Return on investment (ROI) measures the profitability of an investment by comparing the return relative to the investment cost. It is calculated by subtracting the initial investment cost from the final investment value, dividing by the investment cost, and multiplying by 100 to get a percentage.

ROI is crucial for businesses as it helps analyze the profitability of potential projects, allocate resources effectively, and prioritize investments that yield the highest returns. It ensures that companies focus on maximizing their profit margins and long-term sustainability.

The duration of an investment can greatly affect ROI. Longer-term investments have the potential to generate higher returns due to the compounding effect but come with increased risks. Considering financial goals, risk tolerance, and investment timeline is essential when evaluating potential ROI.

Key factors influencing ROI include the investment time frame, risk and return balance, and investment costs such as fees, commissions, and taxes. Understanding these factors helps in making informed investment decisions to maximize returns.

To maximize ROI, diversify investments across different asset classes, industries, and regions. Regularly review investment performance, reinvest returns, and continuously monitor market trends to make necessary adjustments.

Common mistakes include overlooking indirect costs such as maintenance fees and taxes, and ignoring the time value of money. Accurate ROI calculations require considering all associated costs and the principle that money today is worth more than the same amount in the future.

Improve ROI by optimizing costs, exploring new investment opportunities, staying updated with market trends, and seeking expert advice. Implementing diversification, regular performance reviews, and reinvesting returns also contribute to higher ROI.