Research Study

Action Maps for Banking Consumers

User surveys reveal desirability of actions for banking consumers in key scenarios.

Emphasis on banking benefits

Banking benefits are 22% more important than good reviews when looking for a new bank.

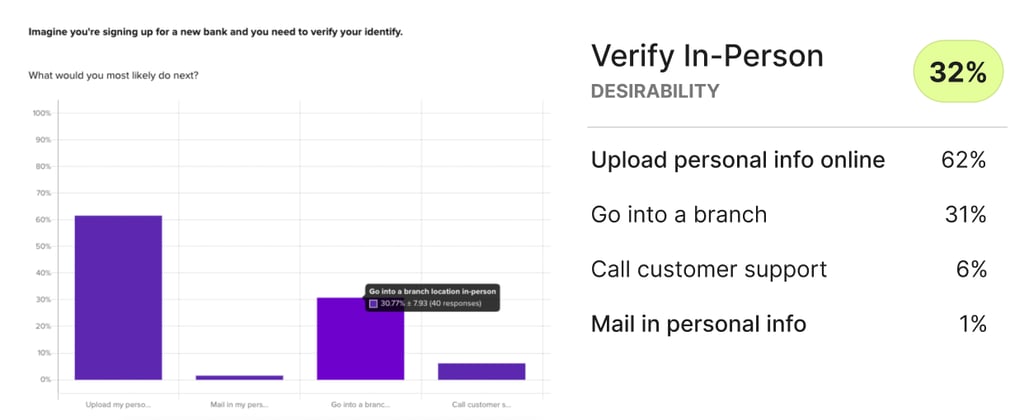

In-person visits for personal identification

Consumers are most likely to go into a branch (31%) when verifying their identity.

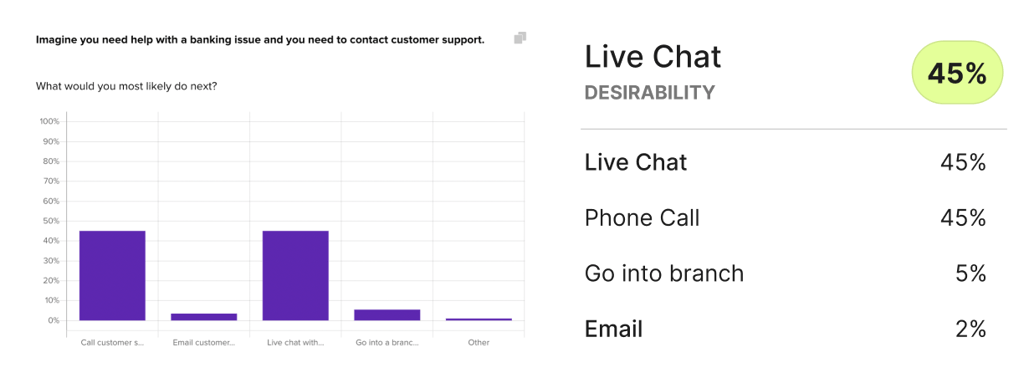

Desirability of live chats & phone calls

Live chats and calls are equally as important (45%) when banking consumers are looking for customer support.

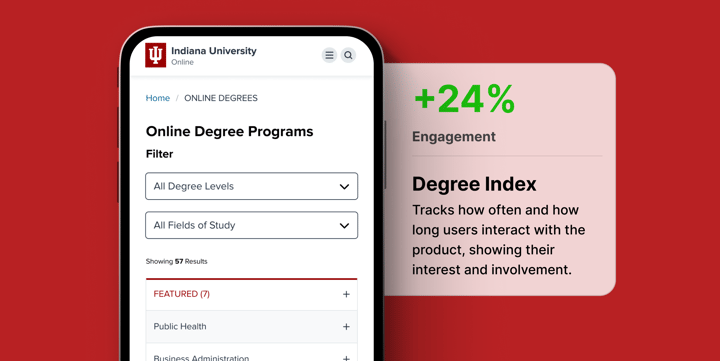

Business Challenge

This independent research aimed to evaluate and optimize the user journeys on Banko’s online banking platform by analyzing user reactions to various service interactions. The goal was to identify the most and least effective touchpoints in the customer journey, providing insights into areas for potential improvement.

Timeline

The testing was completed in 24 hours. After running the test overnight, the findings were synthesized the following day.

Research Goals

The primary objective of the research study was to map out consumer preferences for various actions related to banking, money advice, loans, and other financial scenarios

Methodology

User surveys were conducted to determine how banking consumers will make decisions at different stages of a journey map flow. Multiple choice options were given for different scenarios, and the most prominent option was tracked through each step of the user journey.

Participant Panel

We used a Helio ready-made audience of Bank Members in the United States. One hundred participants reacted to each of the seven scenarios we tested.

Test Setup

Participants were presented with several scenarios, including finding a new bank, searching for car loans, getting financial advice, and making loan payments.

They were asked to select their preferred actions from multiple options, such as reaching out to a financial advisor, reaching out to a friend, or simply looking for the best rates online.

Findings

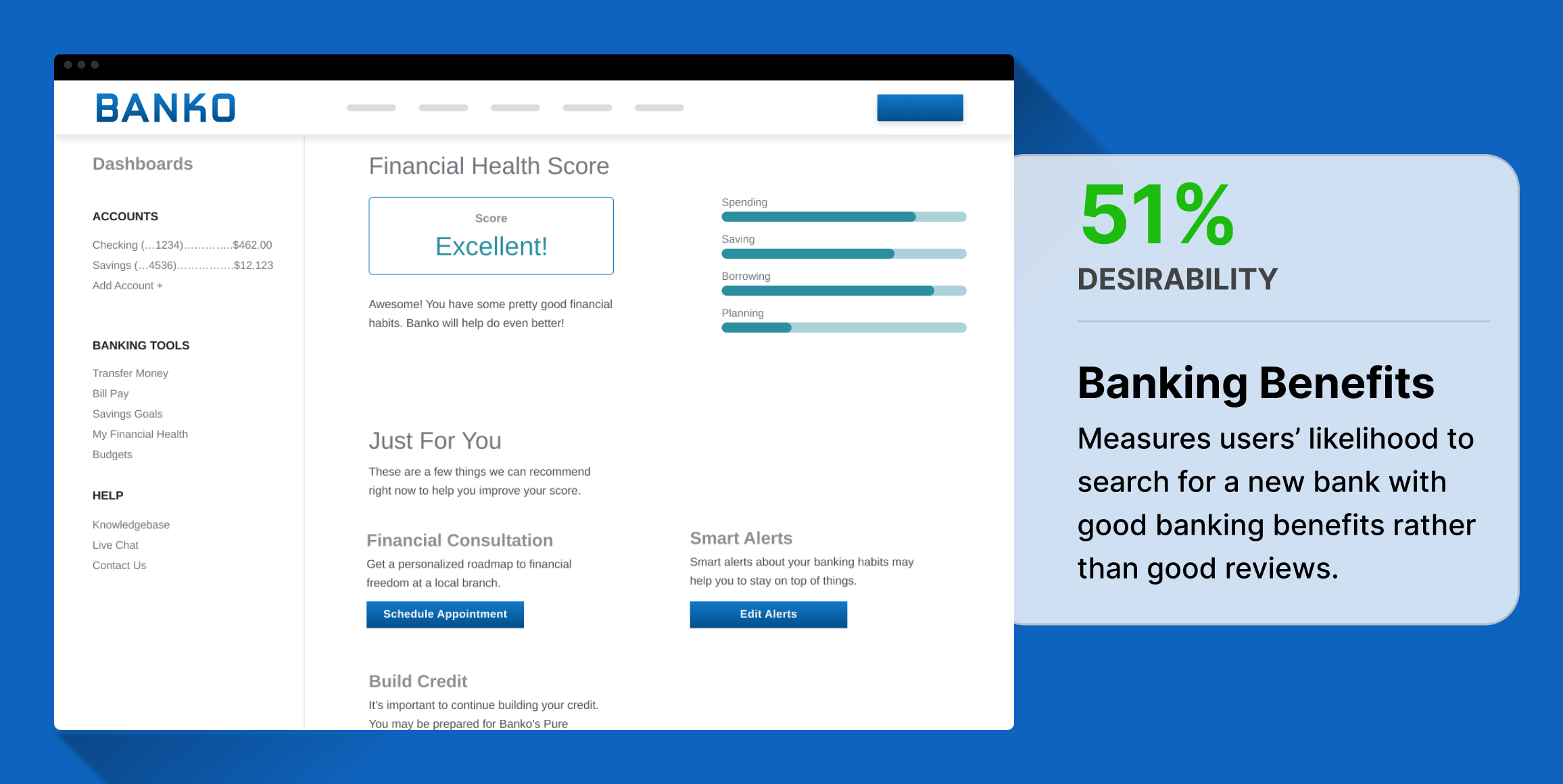

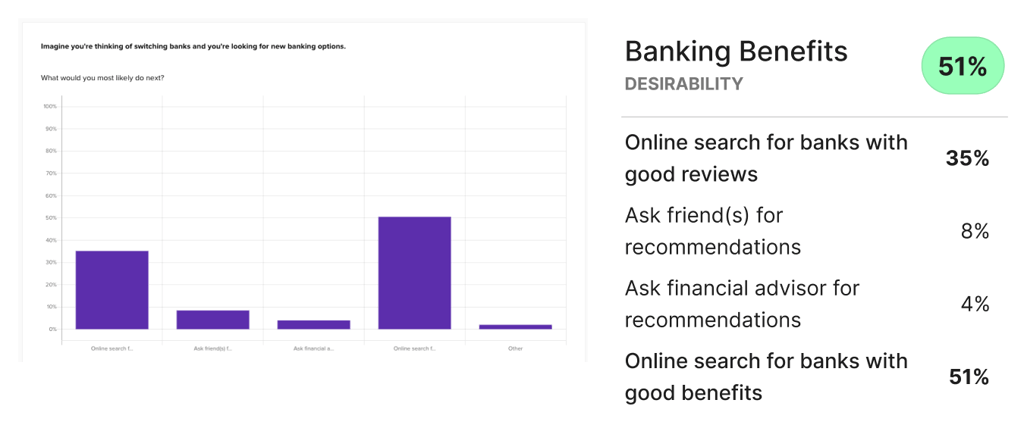

Emphasis on banking benefits

- Banking benefits are 22% more important than good reviews when looking for a new bank

- The majority of participants (54%) would search online for banks with the best benefits when looking for a new bank. This was much more important that finding a bank with good reviews (32%) or asking a friend (9%).

In-person visits for personal identification

- Consumers are most likely to go into a branch (31%) when verifying their identity

- This is the scenario with the highest likelihood of participants visiting a branch in-person, 20% higher than any other scenario. This indicates that hesitation for completing identity verification online might be a hurdle that the banking platform needs to overcome.

Importance of live chats & phone calls

- Live chats and calls are equally as important (45%) when banking consumers are looking for customer support

- An equal amount of participants indicated they would make a phone call or start a live chat when looking for customer support. Even though live chats have become more and more popular methods of communication online, this shows that consumers clearly need access to their traditional channels of outreach.

Conclusion

The user journey mapping study provided critical insights into the effectiveness of Banko’s online banking platform. Identifying key areas of user satisfaction and frustration helps pinpoint where improvements are needed to enhance the overall customer experience.

Recommendations

- Simplify Navigation: Streamline the user interface to reduce complexity and the number of steps needed to complete common tasks.

- Enhance Support Features: Incorporate more visible and accessible customer support features directly within the user journey.

- Iterative Testing and Refinement: Continue to test and refine the user interface based on ongoing feedback and emotional reaction analysis to better meet user needs.

Reflections

This research underscores the importance of understanding detailed user interactions and emotional reactions to optimize online banking platforms. For Banko, such insights are invaluable in crafting a user-friendly system that not only meets but exceeds customer expectations, ultimately fostering loyalty and satisfaction.