Research Study

Banking App Usage & Attitudes

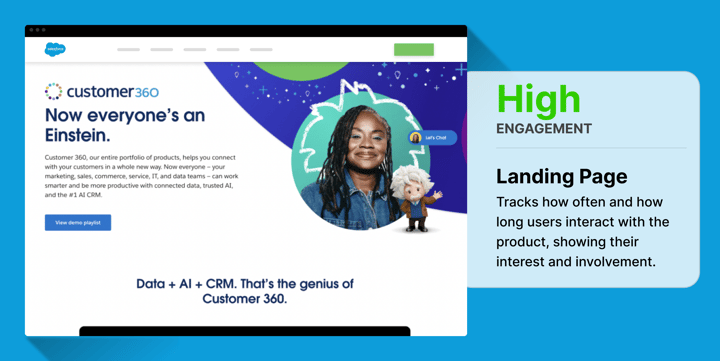

Established market opportunities for a banking platform through Usage & Attitudes (U&A) study.

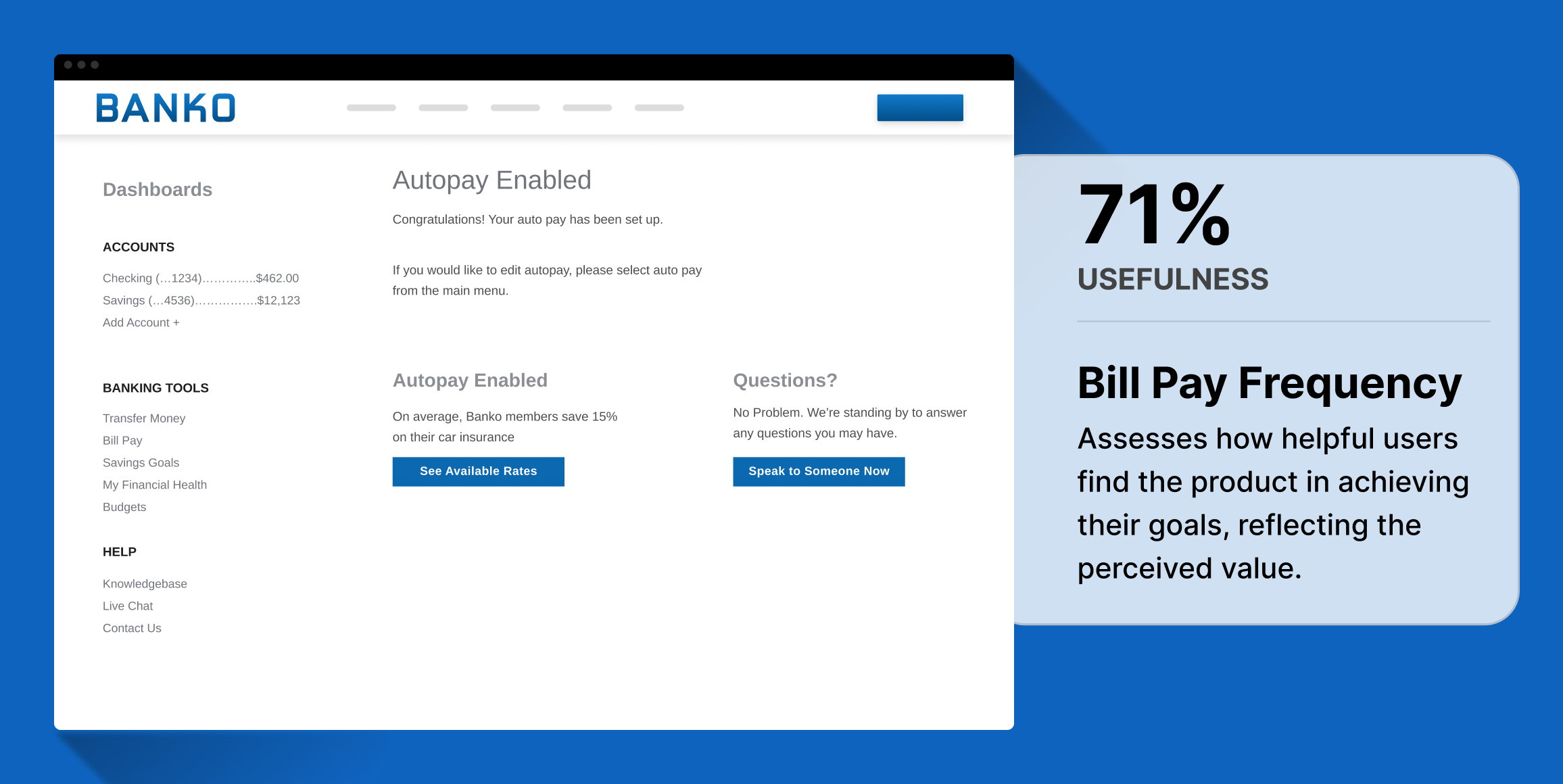

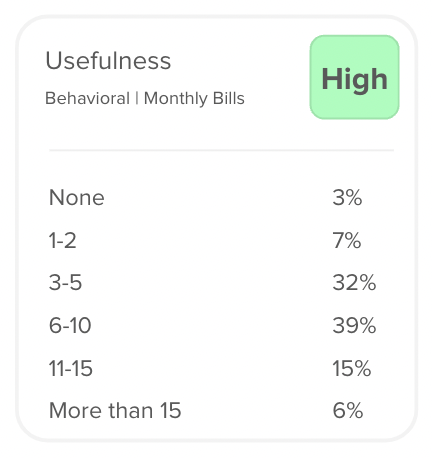

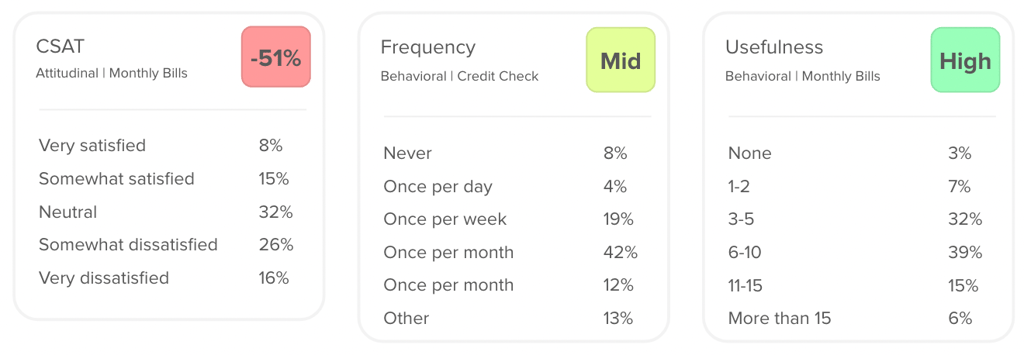

Usefulness impacted through monthly billing systems

Most participants handle multiple monthly bills (ranging from 3 to more than 15), emphasizing the necessity for an efficient, user-friendly bill management system.

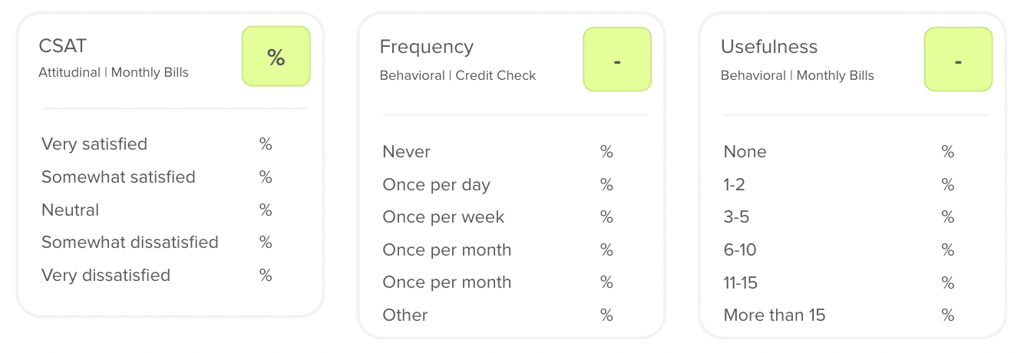

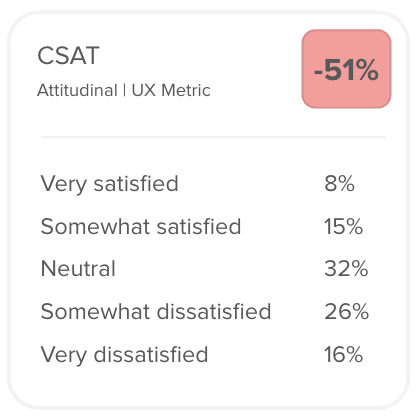

Satisfaction improved through bill management

A significant portion of participants expressed dissatisfaction with their current amount of monthly bills, indicating potential stress or financial strain.

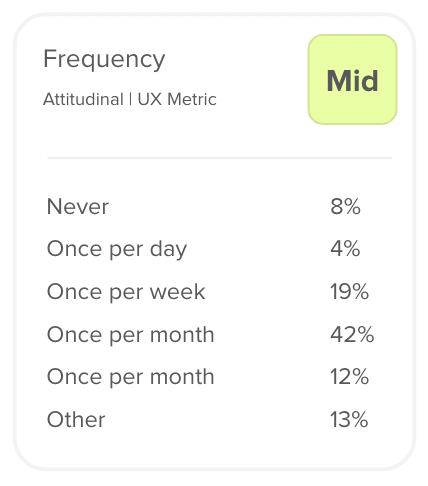

Frequency increased with credit monitoring

The majority of users check their credit score monthly, highlighting the importance of credit monitoring tools.

Business Challenge

We aimed to understand how the services of a theoretical online banking platform called Banko fits into the financial lifestyles of its users in the United States. The challenge was to gather actionable insights into user satisfaction, bill management habits, and credit monitoring behaviors to enhance Banko’s service offerings and user experience.

Timeline

Over the course of 24 hours, we determined some key behaviors and attitudes that might matter to an online banking platform, and put them into a Helio test. By the next day, we had received 200 responses from our audience and were able to construct a framework to outline consumers’ Usage & Attitudes.

Research Goals

The primary goal of this study was to observe the usage and attitudes of banking consumers with their current online banking platforms.

Methodology

We used Helio’s remote user surveys to ask behavioral and attitudinal questions of participants in our audience of banking consumers. Responses were analyzed through Helio’s data reporting tools.

Participant Panel

We ran the survey with 200 participants from a Helio ready-made audience of Bank Members in the United States.

Test Setup

Participants completed online surveys that included questions about:

- Their current satisfaction with the amount of monthly bills.

- The number of monthly bills they manage.

- The frequency at which they check their credit scores.

Findings

Bill management satisfaction

A significant portion of participants expressed neutrality or dissatisfaction with their current amount of monthly bills, indicating potential stress or financial strain. This suggests a need for Banko to enhance its bill management tools and financial planning resources.

Credit monitoring frequency

The majority of users check their credit score monthly, highlighting the importance of credit monitoring tools. This reflects an opportunity for Banko to integrate more robust credit tracking features, potentially influencing user engagement and retention positively.

Usefulness of monthly billing systems

Most participants handle multiple monthly bills (ranging from 3 to more than 15), emphasizing the necessity for an efficient, user-friendly bill management and payment system within Banko’s platform.

View the Banko Usage & Attitudes Survey

Conclusions

The findings from Helio’s user surveys revealed banking consumers current behaviors and impressions of their financial experiences, from monetary satisfaction to frequency of certain behaviors:

Recommendations

Based on the survey findings, the following recommendations were made:

- Enhance Bill Management Features: Develop and promote tools that aid in tracking, managing, and optimizing monthly bills, potentially incorporating budgeting and financial planning aids.

- Integrate Credit Monitoring Tools: Enhance the platform’s credit score tracking functionalities, providing users with regular updates and insights into their credit status.

- User Education and Support: Implement educational resources and support systems to help users understand and manage their financial health effectively.

Reflections

This case study illustrates the critical role of U&A testing in aligning a digital banking platform’s features with the real-world needs of its users. By understanding user satisfaction levels, financial management habits, and preferences, Banko can tailor its services to better meet user expectations, thereby improving satisfaction and loyalty. This approach not only helps in identifying areas for improvement but also highlights the potential for innovative service enhancements.